How to Remove a Name from a Title Deed

How do I remove a name from a title deed?

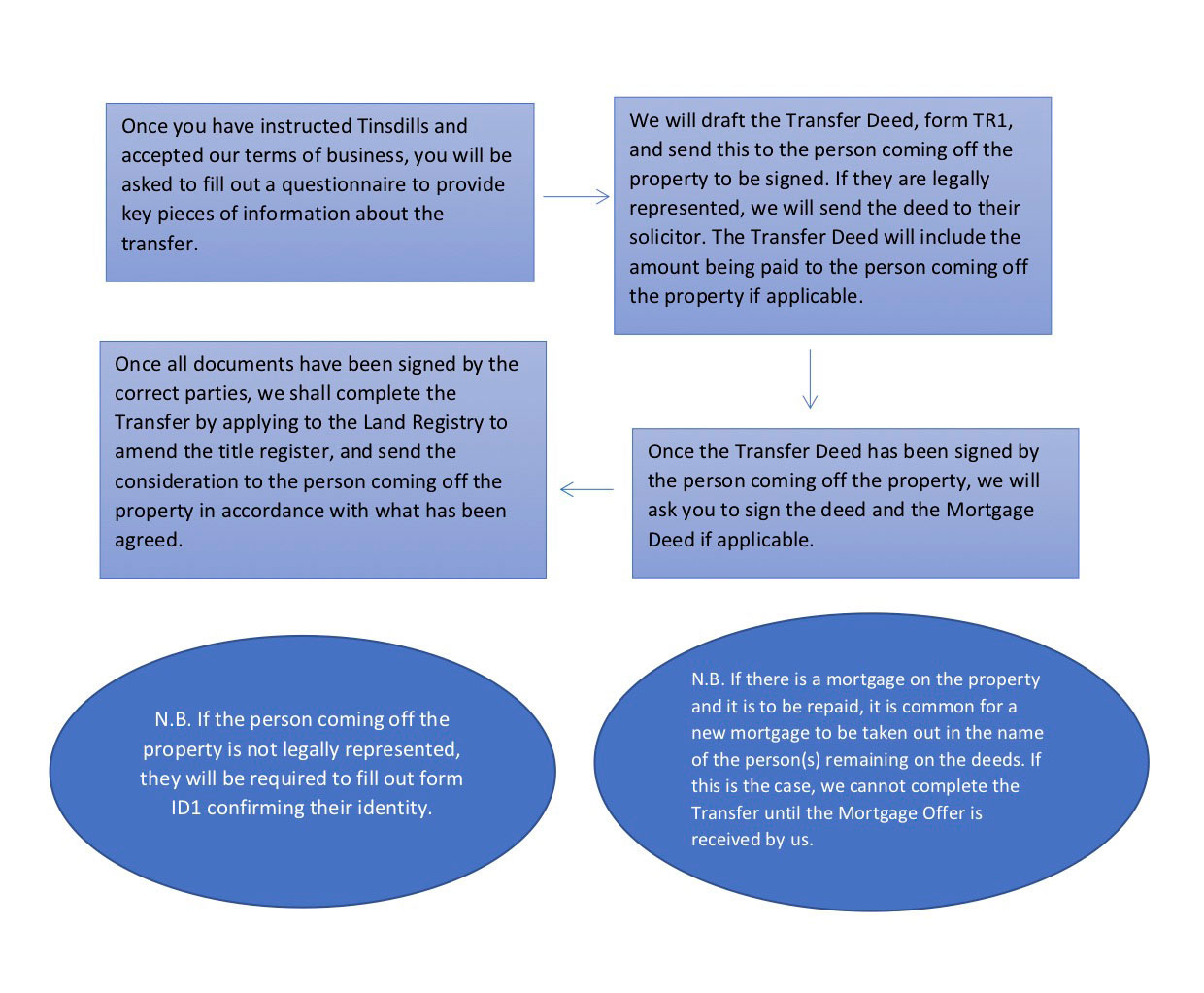

1. Fill in a questionnaire to provide key information regarding the transfer.

2. We will draft the transfer deed (TR1) and send this to the person being removed for signing.

3. We apply to the land registry to amend the title register, and send consideration to the removed party.

4. You will sign the deed (& mortgage deed if necessary). All done!

There are several reasons why you might need to know how to remove a name from a title deed for a property, and each situation calls for various courses of action, which are listed below.

Here we will detail the process of removing a name from a title deed in the most straightforward circumstances, before detailing amendments in accordance with common complications.

The process of removing a name from a title deed is called a transfer, of which there are three main types:

- A gift of no consideration: This means that the previous owner signs over their share of their property with no expected benefits i.e. no money changes hands.

- The removal of a name following death.

- A transfer 2-1 with or without a mortgage: Where there is a mortgage or financial consideration involved, lender approval must be sought or a new mortgage put in place in the name of whichever party is retaining the property.

The Steps – Acting on behalf of the person remaining on the title deed (2-1 Transfer)

Other Considerations

There are a few things that you’ll need to consider when attempting to remove a name from a title deed. These are:

Matrimonial advice

The transfer doesn’t mean that the person being removed from the deeds to the house can’t claim on a divorce.

Insolvency advice

If the transfer is to avoid a property being given to creditors in the case of bankruptcy, this can be set aside by trustees in the bankruptcy.

Leasehold properties

You may need the Freeholder to consent to the transfer.

Short ownership

If the property has been owned less than 6 months and there will be a new mortgage on the property, your lender will need to approve this.

Stamp duty land tax

Stamp Duty may be payable under some circumstances.

If the transfer is a gift for no consideration, which can mean that the transfer works as a gift from parents to children, you’ll need to consider the following things:

- Whether the transfer is consistent with wills/tax advice/financial advice.

- Your rights to continuing occupation, and associated costs.

- Any nursing home/care fees.

Similarly, if the transfer is the removal of a name following death, you’ll need to be aware of the following processes:

Property owned jointly

You will need to make an application at the Land Registry to remove the name. The application will need to be supported by a copy of the death certificate.

Property owned in common

You may need to appoint trustees and take out a grant of probate.

How We Can Help?

At Tinsdills Solicitors, we specialise in simplifying the process so that you can complete the transfer in full confidence, knowing that every box is ticked and you’re fully aware of what’s happening in every aspect of the journey.

If you require help regarding removing a name from a title deed, feel free to get in touch with us. You can give us a call on 01782 652300. Alternatively, you can drop us an email at lawyers@tinsdills.co.uk.